Regulatory restrictions now necessitate that a great number of firms demand that their clients provide identification. In accordance with the Anti-Money Laundering Office’s recommendations, an IAL 2.3 level of identification verification is required to open a digital asset account using the one-stop investment app InnovestX.

However, there are obstacles that developers must investigate to discover the best solution for creating a digital identity verification system. The eKYC technology developed by SCB TechX has been used by InnovestX to facilitate the rapid and trouble-free implementation of an identity authentication system for its investment application.

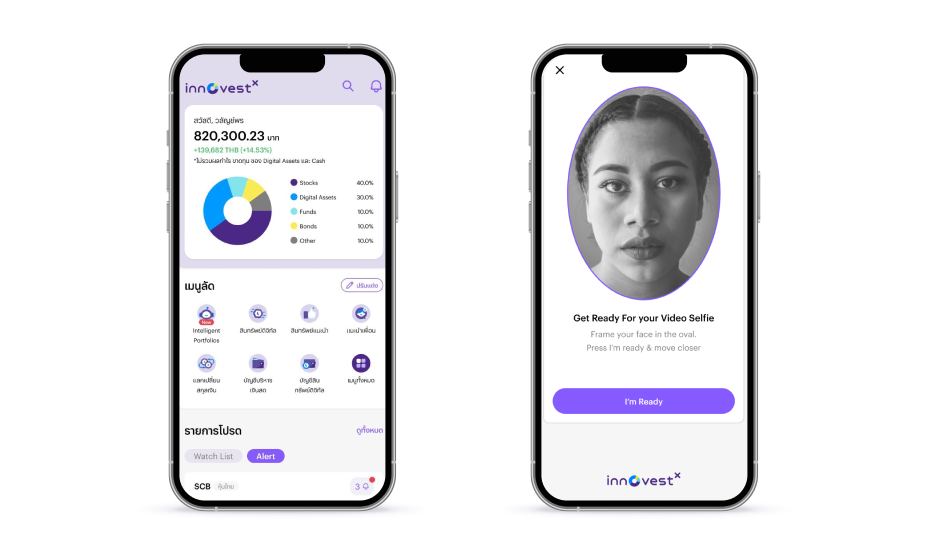

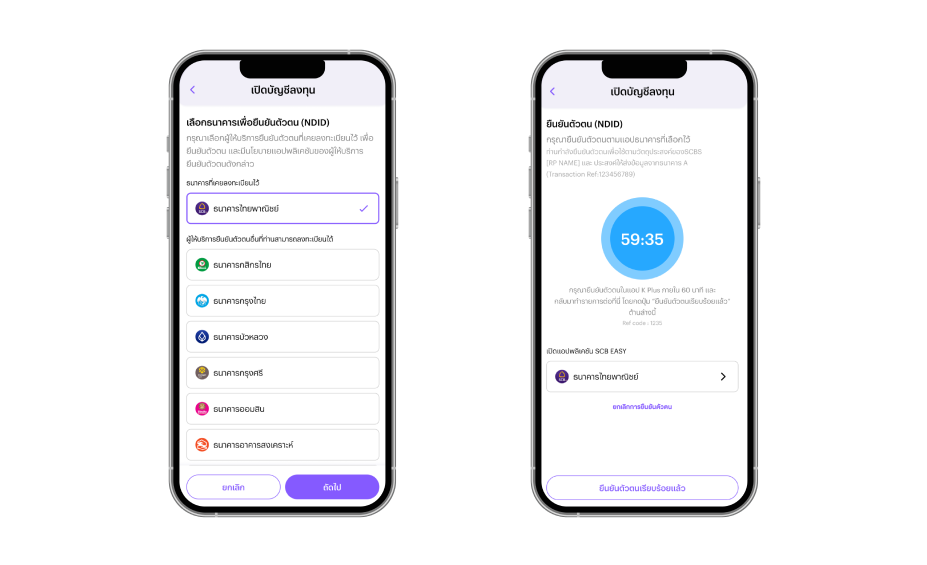

The eKYC solution from SCB TechX is a digital identity verification solution designed to be used right away, with all of the necessary features already included. InnovestX uses NDID Proxy, which connects to the NDID (National Digital ID) platform and enables users to verify their identification in a cross-platform manner with the Liveness & Face Recognition feature, which checks if a user’s selfie matches a photo from a reliable source.

SCB TechX not only provides ready-to-use innovations, but also a team of professionals to help with any issues that may emerge during the implementation of various innovative eKYC features.

The short timeline presented a difficulty for InnovestX during the construction of the NDID Proxy feature because NDID needed the feature installed by a certain time. SCB TechX and InnovestX collaborated on an implementation plan that streamlined the process by eliminating unnecessary steps and double-checking work along the way. This paved the way for SCB TechX to implement NDID Proxy capability in a timely and uniform manner.

Another issue encountered was that some customers could not use the face verification feature since their selfies were being transformed into high-resolution 3D vector images when they used the Liveness & Face Recognition tool. In certain cases, even when using photos from trustworthy sources, the algorithm was unable to correctly identify faces since the images were of inadequate 2D quality. SCB TechX’s experienced team was able to resolve this issue by adapting the feature’s algorithm to the specific scenario at hand. This facilitated faster and more precise face matching.

SCB TechX’s ready-to-use innovations, such as eKYC, provide an alternative for businesses seeking to establish a system or platform in order to quickly offer new products and services.